ev charger tax credit form

Form 1041 Schedule G. The value of the EV tax credit youre eligible for depends on the cars battery size.

Ev Charging Stations 101 Wright Hennepin

It covers 30 of the cost for equipment and installation up to 30000.

. Unlike some other tax credits this program covers both EV charger hardware AND installation costs. It applies to installs dating back to January 1 2017 and has been extended through December 31 2021. This video covers how to complete IRS Form 8911The federa.

This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence. The expiration of this. Since installation costs are significant for EV chargers this rule.

Essentially any PHEV that meets the minimum requirements as outlined above qualifies for at least 2500. Its subject to TMT whereas other credits like The EV car credit and Solar credits arent. A 1500 rebate for the purchase of an all-electric motorcycle.

This importantly covers both components on charging costs. 2021 is the last year to claim a tax credit on the installation of your plug-in electric vehicle. Grab IRS form 8911 or use our handy guide to get your credit.

Install costs can account for the majority of the total cost of installing EV charging especially for commercial installations. The tax credit is available only to businesses. It cannot be used to increase your overall tax refund it is still a.

Federal EV Charging Tax Credit. Of course all of this adds up to 12k so Im trying to figure out how to get the EV and EVSE credits to apply first followed by the solar credit since I understand the solar credit. Regular tax before credits.

Jan 26 2022 12452 PM. Credits on Form 1040 1040-SR or 1040-NR line 19 and Schedule 3 Form 1040 lines 2 through 5 and 7 reduced by any general business credit reported on line 6a any credit for prior year minimum tax reported on line 6b or any credit to holders of tax credit bonds reported on line 6k. The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation costs but it expired on December 31 2021.

From what I see our total tax liability is 12k for 2021. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations. Ad Looking for ev charging station tax credit.

FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED. The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit. However some states still have a tax credit for installing electric vehicle charging stations at your home.

Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchase d EV charging infrastructure. Credits that reduce regular tax before the alternative fuel vehicle refueling property credit. Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax.

The federal government offers tax incentives for businesses to install Level two and three EV chargers. The tax credit allowed is 10 of the cost of the charger and its installation or 2500 whichever is less. Tax credits are available for EV charger hardware and installation costs.

Enter the sum of the amounts from Form 1040 1040-SR or 1040-NR line 16 and Schedule 2 Form 1040 line 2. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Application forms will be available on this webpage during open rebate cycles.

Enter the total of any write-in. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. If your business has multiple locations you can.

The 30 federal tax credit for installing electric vehicle charging stations at your home or business expired at the end of 2017. Enter the regular tax before credits from your return. No there is no federal tax credit for installing an electric car charger at your home in 2018.

Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021. The Electric Vehicle Charger and Converted Vehicle Tax Credits. You use form.

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. By filling out Form 8936 at the same time that you file your federal tax returns you can qualify for up to 7500 in tax credit earnings. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station.

Basically if you have enough credits for the year even if you still have tax liability and no AMT your TMT will dictate if you will get the EV Charger credit. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

Figured it out. However the credit is worth up to 7500 depending on the size of the battery. After the base 2500 the tax credit adds 417 for a 5-kilowatt-hour.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. Just buy and install by December 31 2021 then claim the credit on your federal tax return. And while it is a non-refundable credit ie.

The incentive can be a large percentage of the charger and installation costs. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial chargers at multiple locations. The EV tax credit is 7500 the EVSE credit on our station is 1000 and our solar credit is 8800.

A 4000 rebate for the purchase of an all-electric vehicle that is not an electric motorcycle. 30 tax credit up to 1000 for residential and 30000 for commercial. Up to 1000 Back for Home Charging.

For residential property 1000 is closer to an absolute cap because a taxpayer can have only one primary residence. Purchasers must apply for the rebate during an open rebate cycle and within 90-days of vehicle purchase. Learn more about how to claim your electric vehicle credits and potentially save thousands of dollars on Tax Day.

For residential installations the IRS caps the tax credit at 1000. Individual homes do not qualify. That could mean up to 30 savings and if your business spends 50000 on EV charger installation you could get up to 15000 back in federal funds.

Content updated daily for ev charging station tax credit. Use this form to figure your credit for alternative fuel vehicle refueling property you. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25.

A qualified charger is one that is rated greater than 130 volts and is designed to charge on.

Can I Get A Tax Credit For An Ev Charger In New York Roy S Plumbing Heating Cooling

How To Claim An Electric Vehicle Tax Credit Enel X

What Is Ev Charging How Does It Work Evocharge

Electric Vehicle Charger Installation

Home Charging For E Mobility Designed By Kiska

Residential Charging Station Tax Credit Evocharge

Commercial Public Ev Charging Station

Tax Credit For Electric Vehicle Chargers Enel X Way

Guide To Home Ev Charging Incentives In The United States Evolve

How To Avoid Ev Charging Cable Theft Kelley Blue Book

How We Could Put An Ev Charging Station On Every Lamp Post

Congress Extends Tax Credits For Electric Car Charging Stations

Charged Up For An Electric Vehicle Future Illinois Pirg

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

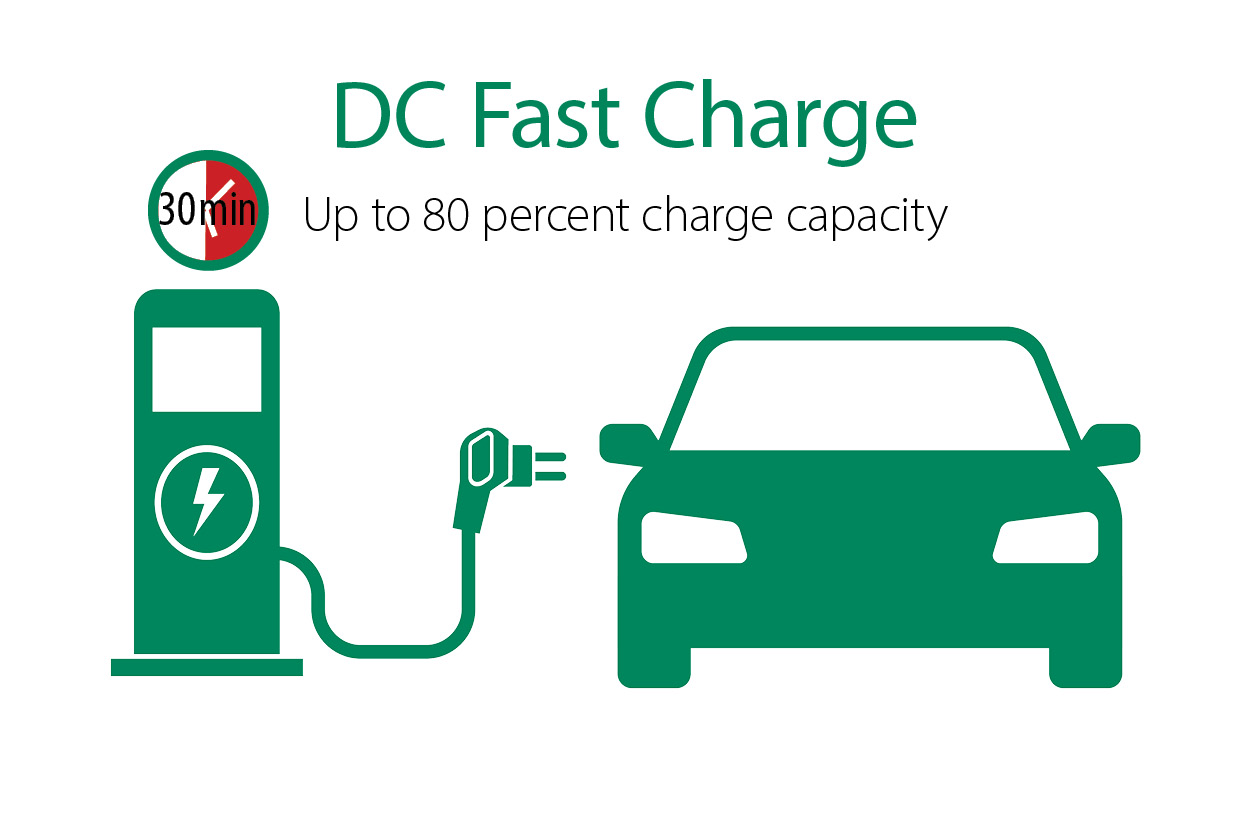

About Electric Vehicle Charging Efficiency Maine

Ev Charger Readiness Comed An Exelon Company

Rebates And Tax Credits For Electric Vehicle Charging Stations

Commercial Ev Charging Incentives In 2022 Revision Energy

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels